Welcome back to Daily Zaps, your regularly-scheduled dose of AI news ⚡

Here’s what we got for ya today:

Nvidia + Groq $20B acquihire deal details

Microsoft CEO admits Copilot integrations don’t work

DHS changes process for awarding H-1B

A new strategy for AI power

Let’s get right into it!

BUSINESS

Nvidia + Groq $20B acquihire deal details

Nvidia’s $20B acquisition of Groq was structured to fully cash out the entire cap table while decisively absorbing Groq’s people, IP leverage, and competitive threat. Shareholders receive 85% of the $20B upfront, with another 10% paid in mid-2026 and 5% by the end of 2026, all at the full $20B valuation.

About 90% of Groq’s workforce, roughly 550 employees, is joining Nvidia, making this likely the largest acquihire in tech history by headcount, an implied $36M per employee. For these employees, vested equity is paid immediately in cash, unvested equity converts to Nvidia stock at the $20B valuation, and roughly 50 key staff receive fully accelerated, all-cash payouts. The remaining 10% of employees, about 50 to 70 people, stay at GroqCloud with vested equity paid out and undefined “economic participation” in the residual entity.

Strategically, Nvidia gains Groq’s SRAM-first inference expertise and non-exclusive rights to its patent portfolio, which is expected to be deployed through non-practicing entities to create a litigation-backed moat that protects Nvidia while deterring competitors. GroqCloud, meanwhile, is left operating 13 global facilities, serving 2.5 million developers and maintaining major contracts such as Saudi Arabia’s $1.5B data center expansion and partnerships with Meta, IBM, and HUMAIN, but without its IP, senior leadership, or core engineering team.

BIG TECH

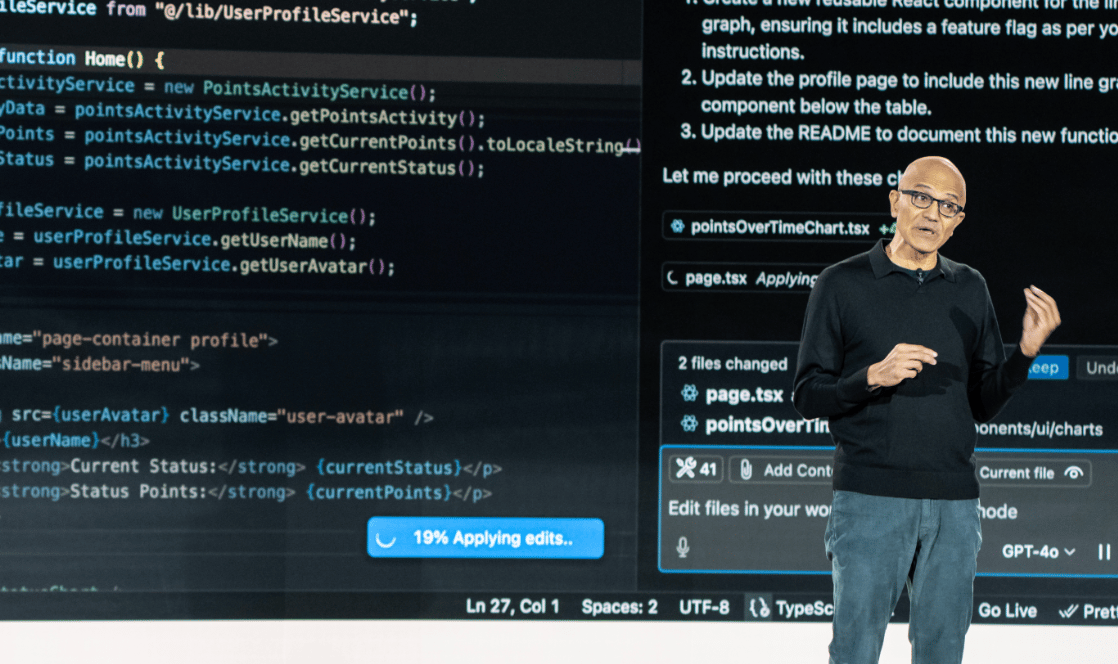

Microsoft CEO admits Copilot integrations don’t work

Satya Nadella has increasingly stepped into the role of Microsoft’s top product manager for AI, delegating business responsibilities to focus on fixing Copilot’s shortcomings and accelerating AI execution across the company. Frustrated with lagging performance, slow shipping, and weaker user adoption compared to rivals like Google’s Gemini and OpenAI’s ChatGPT, Nadella has become deeply involved in product reviews, engineering meetings, recruiting top AI talent, and partnerships with firms like Anthropic.

Despite Microsoft’s strong position and early enterprise lead through OpenAI, Copilot adoption, especially within Office 365, has been uneven, with some customers scaling back usage and others questioning the value versus free alternatives. While Microsoft still reports growth among large enterprise customers, Nadella has warned internally that this is a critical inflection point, emphasizing speed, product quality, and real automation value as essential for Copilot to become indispensable and for Microsoft to avoid repeating past strategic missteps.

The Next Gold Rush

Lithium demand’s fueling a modern-day gold rush. Essential for EVs, robots, and AI, Elon Musk said it best: “Do you like minting money? Well, the lithium business is for you.” Enter EnergyX. Their tech can recover up to 3X more lithium than traditional methods. They’ve secured a strategic investment from General Motors, raised $150M+, and earned a $5M DoE grant. Join 40k+ people as an EnergyX investor.

Energy Exploration Technologies, Inc. (“EnergyX”) has engaged Nice News to publish this communication in connection with EnergyX’s ongoing Regulation A offering. Nice News has been paid in cash and may receive additional compensation. Nice News and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest could create a conflict of interest. Please consider this disclosure alongside EnergyX’s offering materials. EnergyX’s Regulation A offering has been qualified by the SEC. Offers and sales may be made only by means of the qualified offering circular. Before investing, carefully review the offering circular, including the risk factors. The offering circular is available at invest.energyx.com/.

GOVERNMENT

DHS changes process for awarding H-1B

The Department of Homeland Security will replace the random H-1B lottery with a weighted selection system starting in FY 2027 that prioritizes higher-skilled and higher-paid applicants, aiming to curb abuse and protect U.S. workers while strengthening competitiveness. Under the new rule, which takes effect February 27, 2026, visas will be more likely awarded to foreign workers earning higher wages and possessing advanced skills, rather than employers flooding the system with low-paid candidates.

With the annual cap remaining at 65,000 visas plus 20,000 for U.S. advanced degree holders, and additional measures such as a $100,000 per-visa employer fee, the change will significantly raise the bar for participation. For high-tech and AI talent, this shifts the H-1B program toward fewer but more elite hires, favoring senior engineers, researchers, and specialized AI experts at top compensation levels, while reducing access for junior or lower-cost foreign labor and pushing companies to be more selective, pay more, and concentrate visas on truly scarce, high-impact technical roles.

ENERGY

A new strategy for AI power

Alphabet’s $4.75B acquisition of clean energy developer Intersect Power marks a strategic shift as Google moves to secure direct control over the energy needed to scale its rapidly growing AI data center footprint. Facing surging electricity demand from AI workloads and rising emissions, Google is moving beyond traditional power purchase agreements to own generation capacity, enabling it to co-locate renewable energy with data centers and better manage sourcing, timing, and development. Intersect brings 7.5 gigawatts of operating solar and storage capacity and another 8 gigawatts in development, much of it in energy-rich Texas, while retaining its brand and leadership and leaving some non-Google-serving assets outside the deal.

The acquisition signals that energy infrastructure is becoming a core strategic asset for big tech, with ownership of clean power emerging as a competitive advantage in an AI-driven future.

In case you’re interested — we’ve got hundreds of cool AI tools listed over at the Daily Zaps Tool Hub.

If you have any cool tools to share, feel free to submit them or get in touch with us by replying to this email.